A technical indicator derived by calculating the numerical average of a particular stock’s high, low and closing prices. The pivot point is used as a predictive indicator. If the following day’s market price falls below the pivot point, it may be used as a new resistance level. Conversely, if the market price rises above the pivot point, it may act as the new support level.

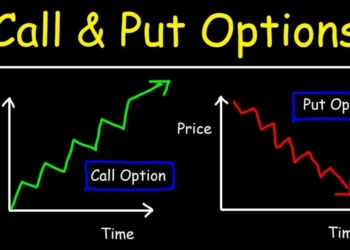

A support level is a price level where the price tends to find support as it is going down. This means the price is more likely to “bounce” off this level rather than break through it. However, once the price has passed this level, even by a small amount, it is likely to continue dropping until it finds another support level.

A resistance level is the opposite of a support level. It is where the price tends to find resistance as it is going up. This means the price is more likely to “bounce” off this level rather than break through it. However, once the price has passed this level, even by a small amount, it is likely that it will continue rising until it finds another resistance level.

The main advantage of this the pivot point is that it is price-based as opposed to indicator-based. By the time most indicators generate a buy or a sell signal, the pivot point move is already well underway. By following this price-based methodology, I will get into a trade before the indicator-based traders, and I usually end up handing off my position soon after a buy or sell signal is being generated on a stochastic or other oscillator type system. The pivot point is especially true on choppy days. On choppy days, it’s the indicator-based traders that get taken out back and shot. Pivot points are set up to naturally take advantage of their mistakes.

The pivot point is also a good system for traders who don’t have time to stare at the charts all day long, or for traders who have a bad habit in chasing the market higher and lower. Playing the pivot point automatically creates trader discipline because the entries and exits are pre-determined before the trading day even starts.

The other thing I like about the pivot point is that they can be used as a tool to quickly determine what kind of trading day it’s going to be. On a trending day, markets will move to a pivot level, consolidate for 15-20 minutes, and then continue to march in the direction of the trend. On these days I wait for the move through the pivot point level, and then buy the first pullback to that level. On choppy days, however, the markets will move up to a pivot point level, hang around for a short time, and then drift back in the direction from whence they came. Many traders get “chopped up” during these types of trading days, losing money and making their brokers rich in the process. The pivot points are naturally set up to be faded on these days and are one of the few profitable ways to trade the low volume, narrow range chop.

Pivot points are mainly used by day-traders to forecast the current day’s support and resistance levels based on the previous day’s high, low and close levels. They are regularly used by chartists and technical analysts as an indicator which is often unbelievably accurate