- Home

- Pricing

- Member Zone

- Pivot Zone

- NSE Pivot Point

- NSE Top 10 Gainers & Losers Pivot Points

- Top 20 Future Stock Pivot Point

- Nifty Option (CE, PE) Support Resistance

- Bank Nifty Option (CE, PE) Support Resistance

- Index Future Daily Pivot Point

- Nifty 50 Stock Daily Pivot Point

- Nifty 50 Stock Weekly Pivot Point

- NSE Future Stock Daily Pivot Point

- NSE Future Stock Weekly Pivot Point

- MCX Pivot Point

- Ncdex Pivot Point

- Comex & LME Pivot Point

- INR Currency & Forex Pivot

- How to Use Pivot Point Level

- NSE Pivot Point

- Free Zone

- Contact

- Home

- Pricing

- Member Zone

- Pivot Zone

- NSE Pivot Point

- NSE Top 10 Gainers & Losers Pivot Points

- Top 20 Future Stock Pivot Point

- Nifty Option (CE, PE) Support Resistance

- Bank Nifty Option (CE, PE) Support Resistance

- Index Future Daily Pivot Point

- Nifty 50 Stock Daily Pivot Point

- Nifty 50 Stock Weekly Pivot Point

- NSE Future Stock Daily Pivot Point

- NSE Future Stock Weekly Pivot Point

- MCX Pivot Point

- Ncdex Pivot Point

- Comex & LME Pivot Point

- INR Currency & Forex Pivot

- How to Use Pivot Point Level

- NSE Pivot Point

- Free Zone

- Contact

Forex Major Currency Pairs Pivot Point Support & Resistance Levels

Forex Major Currency Pairs Pivot Point Support & Resistance Levels for Intraday

What are Pivot Points?

Pivot points are price levels calculated using the previous trading period’s high, low, and closing prices. They are used to anticipate potential future price movements and to identify possible support and resistance levels. The pivot point itself is considered the average price for the period and a point around which the market is expected to fluctuate.

Calculating Pivot Points for Forex Pairs:

The standard pivot point (PP) is calculated as follows:

PP = (High + Low + Close) / 3

From this central pivot point, support and resistance levels are derived. There are several variations, including the standard, Camarilla, and Fibonacci methods. A simple example of calculating the first support (S1) and resistance (R1) levels using the standard method is:

R1 = (2 * PP) – Low S1 = (2 * PP) – High

More complex calculations involve additional support (S2, S3) and resistance (R2, R3) levels, providing a more detailed picture of potential price action. Numerous online pivot point calculators can automate these calculations, but understanding the underlying formulas is always beneficial for traders.

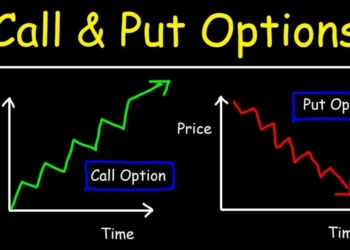

How to Use Pivot Points in Forex Trading:

- Identifying Potential Support and Resistance: Traders use pivot points and their support and resistance levels to identify potential areas where the price might encounter resistance during an upward move (resistance levels) or find support during a downward move (support levels).

- Gauging Market Sentiment: If the price is trading above the pivot point, it generally suggests a bullish sentiment for the current period. Conversely, trading below the pivot point indicates a bearish sentiment.

- Setting Stop-Loss Orders: Support and resistance levels can be strategically used to place stop-loss orders. For example, a trader might place a stop-loss order just below a support level to limit potential losses if the price moves against their position.

- Defining Target Price Levels: Resistance levels can serve as potential target price levels for long positions, while support levels can be used as target price levels for short positions.

- Combining with Other Indicators: Pivot points should not be used in isolation. It’s essential to combine them with other technical indicators, such as moving averages, the Relative Strength Index (RSI), or the Moving Average Convergence Divergence

(MACD), to confirm potential trading signals and increase the probability of success.

Daily vs. Weekly Pivot Points:

- Daily Pivot Points: Calculated using the previous day’s high, low, and close prices, daily pivot points are most useful for short-term, intraday traders.

- Weekly Pivot Points: Calculated from the previous week’s high, low, and close prices, weekly pivot points are more relevant for medium-term traders who are looking at broader market trends.

Importance for Major Currency Pairs:

Understanding pivot points is crucial for trading major currency pairs due to these markets’ high liquidity and volatility. Pivot points can provide valuable insights into potential price movements and help traders make more informed decisions.

Disclaimer: This information is for educational purposes only and does not constitute financial advice. Forex trading involves substantial risk, and you could lose money. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Related Posts

© 2008-2025 SHUBHLAXMI COMMODITY