NCDEX Commodity Daily Pivot Point

NCDEX Commodity Daily Pivot Point table will show you Daily support resistance with 3 major points. So the main factor to create a pivot point is the Previous Week's high, low and close price. It’s a big headache to count Daily pivot points for a trader and that’s why we have introduced this page where you can come back daily and get the NEDEX Commodity Daily pivot levels. This page is updated daily to give you Daily pivot points level for most of the scripts like Castorseed, Chana, Cotton Seed Oil Cack, Crude palm oil, Coriander, guar seed, Guar Gum, Jeera, Kapas, Pepper, Rm Seed Oil Cack, Mustard Seed, Sugar, Soybean, Soy oil, Turmeric, Wheat and Much More

Pivot Point

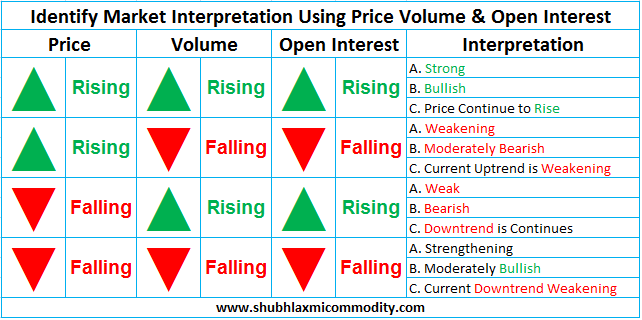

A technical indicator is derived by calculating the numerical average of a particular stock's high, low, and close prices. The pivot point is used as a predictive indicator. If the following day's market price falls below the pivot point, it may be used as a new resistance level. Conversely, if the market price rises above the pivot point, it may act as the new support level.

Ncdex Weekly Pivot Points MCX Online Chart