Unveiling Market Secrets: Price, Volume, and Open Interest

Unveiling Market Secrets Price, Volume, and Open Interest

Understanding the Impact of Trader Behaviour and Market Hours on Open Interest and Trading Volume

Understanding the Impact of Trader Behaviour and Market Hours on Open Interest and Trading Volume

Introduction

In the world of commodity markets, traders constantly analyse various data points to make informed decisions. Among these, open interest and trading volume stand out as crucial indicators of market activity and sentiment. However, interpreting these metrics requires a nuanced understanding of the factors that can influence them. This article delves into two key factors that can significantly impact open interest and trading volume: trader behaviour near contract expiration and the effects of half-working days.

Open Interest and Trading Volume: A Quick Overview

Before we dive into the specifics, let’s briefly define the key terms:

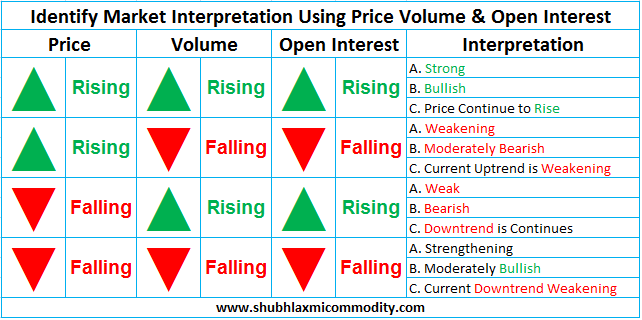

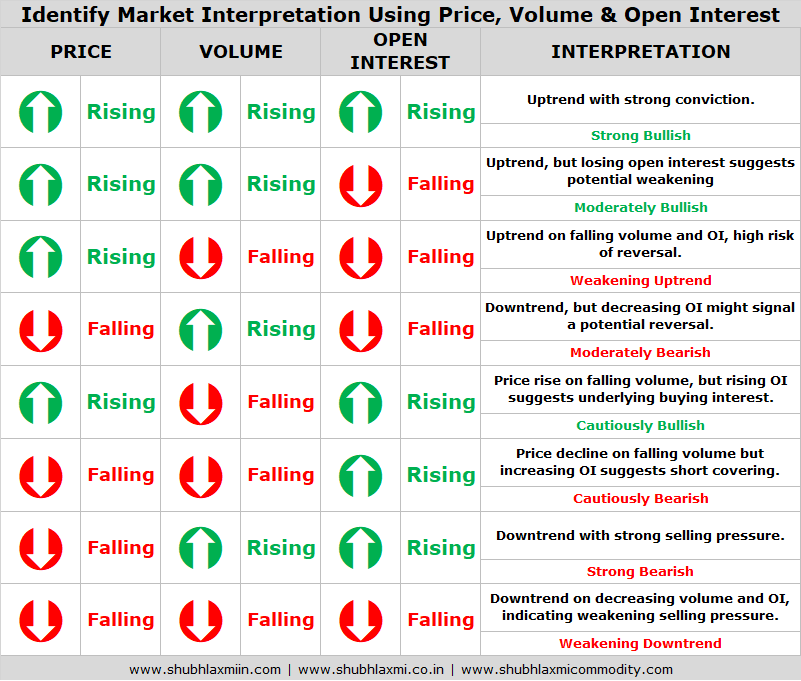

- Open Interest: The total number of outstanding contracts (both long and short) for a particular commodity at a given time. It reflects the level of participation and liquidity in the market.

- Trading Volume: The total number of contracts traded during a specific period. It indicates the level of activity and interest in a particular commodity.

Trader Behaviour Near Contract Expiration

As a contract’s expiration date approaches, traders typically engage in one of two actions:

- Squaring Off: Closing existing positions by selling long positions or buying back short positions. This reduces both open interest and trading volume.

- Rolling Over: Shifting positions to a later-dated contract to maintain market exposure without taking physical delivery. This can temporarily increase trading volume in the new contract, but still decrease open interest in the expiring contract.

This behaviour is driven by the desire to avoid taking physical delivery of the underlying commodity, which can be logistically challenging and costly. The timeframe for this activity typically falls within three to four days before the contract officially expires.

Impact of Half-Working Days

Impact of Half-Working Days

Half-working days, characterized by reduced trading hours due to holidays or other reasons, can also significantly impact trading activity. The shorter trading window directly limits the time for traders to enter or exit positions. Additionally, some traders may choose to stay out of the market on these days, further reducing overall activity.

If not interpreted cautiously, this can lead to lower open interest and trading volume figures, potentially misrepresenting the underlying market sentiment.

Additional Factors

Besides trader behaviour and market hours, several other factors can influence open interest and trading volume:

- Market Volatility: Increased volatility can lead to higher trading volume as traders actively adjust their positions.

- News and Events: Major news releases or unexpected events can trigger significant trading activity and impact open interest.

- Seasonal Factors: Seasonal changes in demand or supply can affect trading patterns and influence open interest.

Interpreting Data with Caution

When analysing open interest and trading volume data, it’s crucial to consider the potential influence of the factors discussed above. Failing to do so can lead to misinterpretations and flawed trading decisions.

For instance, a sudden drop in open interest near contract expiration might not necessarily indicate a lack of interest in the commodity. Instead, it could reflect traders squaring off or rolling over their positions. Similarly, lower trading volume on a half-working day might not be a cause for concern, as it’s likely due to the reduced trading hours.

Conclusion

Open interest and trading volume are valuable tools for understanding market dynamics in commodity markets. However, their interpretation requires a comprehensive understanding of the factors that can influence them. By considering trader behaviour near contract expiration, the effects of half-working days, and other relevant factors, traders will gain a more accurate and nuanced view of market sentiment and make more informed trading decisions.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any trading decisions.

If you liked this article, please share it on social networking. You can also find us on Twitter, Facebook, YouTube, and Instagram, Telegram.